Check your ideology at the door

Perhaps the biggest economic topic in Ethiopia today is foreign currency. Sadly, much of the discussion around it is low quality. Instead of reasoning from first principles, people drown in jargon and misunderstood theories: inflation, socialism, neoliberalism, colonialism, IMF, China, bla bla bla. Whether the motivations are naivete or special interests, the result is many strongly held but incoherent beliefs. To navigate this, let's be guided by this (perhaps apocryphal) quote from the great physicist Richard Feynman: "If you can't explain something to a child, there's a chance you don't understand it well". So don't let any expert tell you: "it's too complex, don't try to understand, just believe my prediction". In that spirit, dear reader, please leave your isms and schisms at the door and join me in this ELI5 version of the problem of foreign currency in Ethiopia.

- In this post, we will talk about US Dollars as the "foreign" currency, but all of it applies equally to Euros or any freely exchanged and widely used currency.

- Feedback is welcome. If there are factual errors, please let me know and I will correct them. If you have a solid counter-argument to any point made herein, feel free to comment here or contact me on Twitter, and I will respond and update the post (with credit!).

Two markets

How much is one US Dollar worth in Ethiopian Birr? Officially the price is pegged, currently at around 55 ETB per USD. But if an ordinary person, let's call him Abebe, simply goes to his bank and asks to buy 1 dollar for 55 birr, they will say no. There is a limited supply of dollars. Ok how about 56, 57, ...? Nope. Now what if at the same time, another customer, let's call her Berhane, has a dollar and she's willing to sell it for 56? Naturally, the bank should be happy to buy that dollar at 56 and sell it to Abebe at 57. The buyer, the seller, and the bank would be happy. Problem solved! Actually no, by law, the bank is not allowed to do that. It must sell only to approved buyers at the official price and if that means those two customers go home unsatisfied, so be it.

So what is the alternative? Abebe and Berhane could meet privately, find a mutually agreeable price and exchange. This is called the parallel market (also known as the "black" market). Of course, even though it's a private transaction, just like when people buy and sell eggs or bread or whatever, information gets around and a market price emerges. These days it is apparently around 105 ETB per USD. No one is forcing this price, it's just a rough average of a lot of private transactions. In each case, the buyer and seller get what they need. Problem solved! Actually no, by law Abebe and Berhane are not allowed to do that.

So we have two markets: the official one where the price is pegged by law, and relatively few people can transact. And the "parallel" market where the price is voluntary but it is illegal.

Mind the gap

Having two markets would be no big deal if they were reasonably close. Even in free market prices, there are gaps due to distance, convenience, time delays, etc. But in this case, one price is almost double the other! This is an extreme gap by historical standards, a structural gap created by a legal barrier between the two markets. Let's examine how this barrier affects different people.

There are two groups, buyers (who have birr and want dollars) and sellers (who have dollars and want birr).

First consider the sellers. What brings dollars into Ethiopia? Roughly:

- Remittances: $6B/yr

- Foreign investment: $4B/yr

- Exports: $4B/yr

- International aid: $3B/yr

- Tourism: $0.4B/year

The buyers of course. Those who get dollars at the pegged rate. To get legal dollars, you need a "letter of credit", which allows the bank to take your birr and give you dollars to use abroad. This permission goes to the government itself and to private imports prioritized by the government.

Debatable priorities and the problem of central planning

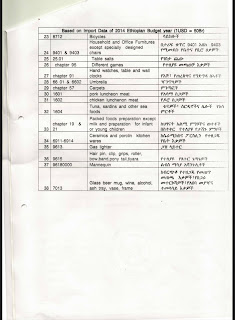

This leaves the Ministry of Finance the unenviable task of deciding the relative importance of hundreds or thousands of things, and deciding which ones should get higher priority for letters of credit, lower priority or none at all. Last October, the government decided to ban letters of credit for 38 items.

The list includes oddly specific items like "Vimto", impossibly vague categories like "Different games", and hilarious ones like "Artificial and Human hairs" and "tiaras". Comedy aside, some choices are really sad. "Bicycles"! That one really broke my heart.

Oil gets a double subsidy: first from foreign currency priority, and second from getting explicit subsidies of the price at the fuel pump. Believe it or not, in Ethiopia which doesn't produce any oil, has a foreign currency crisis, and where less than 1% of the population has cars, the price of gasoline is half of the price in neighboring Kenya! Fuel subsidies may be one thing that is even crazier than the foreign currency nightmare, but let's leave that for another post.

Meanwhile, businesses are suffocating because they can't get foreign currency. If you make electrical equipment, you can't get the dollars to import copper, so you stop and wait. If you are constructing a building, you can't get dollars to buy steel, so you stop. Over 200 business ceased operations because of lack of foreign currencies. Manufacturers are getting less than 15% of the foreign currency they need for raw materials, according to the Ministry of Finance. A common sight around Addis Abeba is unfinished buildings, sitting half-built for months or years, a constant demonstration of wasted land, wasted capital, lost opportunities. If you talk to anybody in manufacturing, you will be overwhelmed with stories of dying companies. Companies fail all the time of course, that's the nature of business. But the heartbreaking thing is they are not failing for business reasons. Imagine you have the right idea, you invest lots of money, hire the right employees, make the right product, find the right customers. You are willing to pay for inputs at market value, but, understandably, you don't want to go to the black market. So you just sit and wait for permission to buy your inputs. And eventually close up shop. That is the tragic fate of many many businesses that could help the livelihood of millions, dying because of this foreign currency policy.

Perhaps the starkest illustration of the failure of this central planning approach to prioritization is: "Lack of forex to import fertilizer threatens agricultural output". Nothing is more important than agricultural production, and the government understands that. So they planned ahead and allocated $1B for fertilizer, much more than last year. But due to global market changes, the need is $1.2B. So here we are with a shortage of fertilizer.

In short what we have is the classic "economic calculation problem" which forever plagues central planning. The problem is not that the planners have bad intentions, nor that they are not smart enough, nor that they don't have the right data, nor that they need more powerful computers. It's more fundamental. In a large economy, the full information to make the optimal allocations simply does not exist in one place at one time no matter how much you try. You cannot sit at a desk and decide for 100M people whether steel is more or less important than copper, or whether aspirin is more important than fertilizer. The information is distributed in the subjective values and decisions of thousands of different actors, and when they act locally on their specific problems, their collective intelligence is much greater than even the best possible central planner.

Inefficiency of indirect subsidies

Further, even if we assume the priorities are perfectly correct and everyone agrees, there is another basic problem. Who pays for them? The cost is of course being born by the sellers we identified above: exporters, people receiving remittances, etc. And the benefit goes to specific imports. Which raises the question: why should coffee exporters or remittances carry the cost of gasoline for car owners? Why shouldn't plumbers, teff farmers or real estate businesses share the burden? A society may decide the rich should subsidize the poor, or some things should have punitive taxes, etc. But implicitly making one sector pay for another specific sector is unfair and inefficient, and leads to many unintended consequences. If the society wants something to be subsidized, then it's better for the government to spend money directly on that thing, using money that it collects through normal explicit taxes. The optimal mix of taxes (VAT, duties, income tax, etc.) is a separate debate the society can have. But whatever the specific combination of taxes, explicit taxes are better than an implicit tax via currency controls.

Corruption

Another problem is that access to foreign currency becomes an exorbitant privilege, so there's an extreme incentive for corruption. Common sense says that when there's a magic way of doubling your money, there's bound to be some cheating. The people who are most adept at playing the privilege game will get more of it, while those who are politically naive get less. To think otherwise is to ignore human nature. Cronyism and corruption is rewarded and productive work is penalized. This is of course extremely damaging to the economic and moral health of the society.

The grey zone

Inevitably, many of those who can't get this privilege resort to the parallel market. Indeed, the black market has become mainstream. Increasingly this is not just individuals like Abebe and Berhane in our story above, but also in business. Research shows that prices of imported commodities are tracking the parallel market rather than the peg. Banks too are flirting with the black market, by adding transaction fees as high as 60% to bridge the gap. Even parts of government are resorting to the black market. For example, earlier this year, there was a huge public bus procurement scandal. The Addis Abeba city government paid 19 million birr per bus, which according to the peg, is about $350K. Critics screamed that those same buses cost less than $150K internationally, so surely someone pocketed the difference! But an alternative explanation soon emerged: the importer had to get their foreign currency at the parallel market rate. Using that rate, and adding the cost of shipping etc., the price seems more reasonable. Should you praise the importer for creative problem-solving (after all the city does need more public buses!), or condemn them for price gouging? You decide. It is a bit like the debate about "illegal" vs "undocumented" immigrants in the US, but much worse. Exploiter and exploited start to blur into an unhappy grey zone. Huge swaths of society are operating outside the law. The hypocrisy is staggering. People will publicly defend the peg and privately use the black market. That's not only legally risky for everyone involved, it's deeply corrosive to the rule of law. Ethiopia is becoming a mafia state.

The solution

The polite economist word for this nightmare is "distortion". And while the consequences are very wide and complicated, there is a simple and narrow solution. The government could simply revoke the law that says Abebe, Berhane and the banks are not allowed to exchange their USD for ETB at whatever price they agree to. That's what is meant by jargon like "float" or "unification", "liberalization", etc. Just let the two parties agree on a price. No other laws need to change. Any product that is illegal can remain illegal. Banking licenses don't need to change. Just decriminalize voluntary price. That's it.

And, surprise! That is actually the current Ethiopian government's position. Don't take my word for it. It said so in 2019: Ethiopia: Central Bank announces floating exchange rate regime. And again in 2020: Ethiopia Plans New Key Rate, Floating Currency to Boost Economy. Even now in 2023, exchange rate unification remains the goal. But the policy is "gradual", and 4 years in, the peg remains and the gap is growing. So what are we waiting for? Why don't they just waive this magic wand today?

The reasons for this inability to execute the change fall in two categories. First, this inefficiency benefits some special interests, even if it hurts the majority. And multi-billion dollar special interests, both within and outside government, are tough get rid of. The second set of reasons is many sincere but misguided fears, both within and outside the government, of what would happen with such a change. Let's examine them.

Inflation: the map and the territory

The most common fear is: if the currency is floated, inflation will go up. But this is due to a misunderstanding. Let's say the international price of copper is $0.10 per gram. And the local competition is such that importers can't make more than 10% profit. If copper is a priority and importers get letters of credit allowing them to buy dollars at 55 ETB/USD, they can import it for 5.50 birr and sell it to you for 6 Birr. Ok great. But if the importers can't get foreign currency, what is the price? It's as if the price is infinity. You could go bankrupt while waiting for copper to be available. Or go to jail buying it from smugglers. Now suppose the importers can get dollars at a market rate legally, they will bring it in at a cost of 10 birr and sell it for 11. The naive academic might say there is inflation because the price went up from 6 to 11. But people in the real world realize that 11 is less than infinity! Scarcity is a form of inflation. Focusing only on official prices while ignoring scarcity is mistaking the map for the territory, or mistaking the thermometer for the temperature.

Of course inflation is a serious problem so it's easy to fall for this fallacy. But would you trust a doctor using a broken thermometer who says: if we fix the thermometer, you will develop a fever? No, you want a practical one who sees the thermometer is broken and that you already have a fever. So while academics and commentators talk about potential inflation, people who provide real goods and services know that the inflation they fear is already happening.

Exchange rate

A closely related concern is that if the exchange rate is floated, then the currency will rapidly lose value. There are three versions of this worry.

Some think that, by some unexplained law of nature, the black market has to remain more expensive than the official market. So if the official market is floated and ETB/USD goes from 55 to 100, then the black market price will go to 200. That is nonsense The black market responds to supply and demand. If there is a functioning legal market, then there's no reason for anyone to pay a higher price and also take the risk of doing something illegal! It's just human nature, people prefer to pay less, and people don't like going to jail.

A more sophisticated version of this worry is the following: in the black market, both supply of and demand for foreign currency are suppressed, and if you legalize free exchange, the demand might increase more than the supply so the market price will be higher. But this is also incorrect. Usually, when there's prohibition, supply is more suppressed than demand. Or to be technical, the elasticity of supply is greater than the elasticity of demand. Without prohibition, all else being equal, the price is lower.

Another variant of the same fear is based on historical examples. In a recent discussion on this topic this example came up: once upon a time, Sudan floated their currency. At the time of the change of policy, the USD on the black market was at 550 SDP. After the float, the market price rose to 600 SDP/USD. So proponents of currency control claim that getting rid of it caused the SDP to lose 10% of its value. But they should note that in the preceding decade, the black market price of USD had risen 5000%! The currency was losing value very fast. And floating it, if anything, slowed it down. Similarly in the case of Ethiopia, I wouldn't say that if the exchange rate is allowed to float today, the price of foreign currency will go down tomorrow! Most likely it will continue to rise but it will slow down. Here's a picture to illustrate the point (the dots represent real values of the black market as reported in news articles over the last 5 years):

In short, the black market price is the free market plus a risk premium. If it is decriminalized, the risk premium goes away. So the black market is an upper bound on what the natural market price would be.

Speculative attacks

A closely related fear is that if the currency is freely exchanged, international currency traders would swoop in and wreak havoc by "speculating". It is true that financial markets can be volatile but let's put that in perspective. That volatility is much less than the brutality of the practical forex market as currently experienced by Ethiopians today. The random shocks of getting or not getting a letter of credit are much worse. You can go for arbitrary length periods with an effective price of infinity and volume of zero!

Sure, if the currency was freely traded, the National Bank of Ethiopia (the central bank) and the Ministry of Finance may make monetary or fiscal policy errors, reserves might run low, etc. But all that would be child's play compared to the devastation the current currency regime is inflicting on the real economy. That said, the government can and should shore up reserves. Two obvious moves: stop fuel subsidies; sell off non-strategic and poorly-performing state enterprises (of which there are many).

Sequencing reforms

A related point often made by academics and commentators is: yes the parallel market should be decriminalized, but first the economy must be strengthened, productivity must increase etc. This argument is a bit like sitting in a burning house and saying: yes the fire is bad, but first let's invest in non-flammable furniture and curtains. It's missing the burning issue. The currency not being freely exchangeable is suffocating the very things that make the economy more productive.

Upside down tiger

Another argument given against free exchange is that some countries, like the so-called Asian Tigers and China, grew their economies while controlling their currencies. The irony is that in those cases, the control consisted of under-valuing their currencies, to promote exports and investments, while suppressing imports and domestic consumption. They essentially delayed the rise in standard of living in exchange for faster industrialization. But what we have in Ethiopia is the exact opposite: the peg over-values the currency, which subsidizes selected imports, while lowering investment, domestic production and exports! You might call this the "upside down tiger" de-industrialization strategy. No country has grown out of poverty this way.

Brace for media impact

If the peg is abandoned, we can be almost sure that a lot of the commentariat will miss these two points:

- they will compare the new free market price to the old peg, instead of comparing it to the old black market price, falling for the map and territory fallacy;

- they will comment on the increase of foreign currency exchange rate, rather than the fact that the rate of increase declines.

Even economics professors confuse a decline in the rate of change with an actual decline in the price! So what are the chances journalists and social media activists will be rational? Low. They will probably scream bloody murder. And governments know that. Hence the "gradual" policy. To be blunt, the political cost of doing the right thing is very high.

Deva!uyashun!1!?

It's amazing how many people think the strength or weakness of a currency is determined by a government simply deciding on a price. And they talk about "devaluation" as if it is a matter of just typing in a larger number. Their concept is: the bad guys will force African countries to use a larger number! Oh no, devaluation! We must fight the IMF! Neocolonialism! Bla bla bla. I'm very critical of the IMF and the current international financial order, but this conception of "devaluation" is complete nonsense. But it is political dynamite and a lot of energy is spent trying to defuse it. Here's how I would respond to it. If you think "government type big number = bad", then ask yourself do you believe that "type small number= good"? If it's that easy, do you think that, tomorrow, the Ethiopian government could set the peg at 50 ETB/USD instead of 55 ETB/USD and all imports would automatically be 10% cheaper? If they peg it at 0.01 ETB/USD would imports suddenly be 5000 times cheaper, and the average Ethiopian would afford a Ferrari? Of course not.

Root cause of currency strength or weakness

From a policy making perspective, the exchange rate is an effect not a cause. It's an output signal, not an input variable. The real price (which is approximated by the black market not the peg) is a reflection of a basic reality: how many dollars are coming, and how many dollars are going out. This is called the balance of payments. The birr gets weaker if the economy is not bringing in enough dollars. Exports and foreign investments are too little compared to the consumption of imports. And this imbalance can only improve if a) the economy produces more things the rest of the world wants, and b) the country is more attractive for investment.

Now as we saw earlier, the first order victims of the peg overvaluing ETB are exporters, investors, and remittance recipients. The gap between the market and the peg is a de facto tax on them so it directly reduces their volume. Fewer dollars come in. At the same time, it's a de facto subsidy of specific imports, which means more dollars go out. Which makes the currency weaker. Which increases the gap. That's the death spiral of a weakening currency. The second order victims are manufacturers and producers more generally; even if they are not exporters, they help the balance of payments by creating products that would otherwise have to be imported. Plus they are part of making the society more productive which improves chances that the society will make stuff the rest of the world wants. Thus, by choking producers, the peg further increases the imbalance, another vicious cycle.

There is no solution that doesn't include facing reality. Recognize that 55 ETB is just not worth 1 USD. The peg doesn't make the currency stronger. A broken thermometer does not cure fever! The cure starts by getting rid of the peg, which will

- in the short term, eliminate the risk premium, improve availability of consumer goods, eliminate an unfair de-facto tax and subsidy, reduce corruption, and stop a major cause of socio-economic rot;

- and in the longer term, increase exports, foreign investments, and productivity of the society, which will help fix the structural weakness of the currency.

People voluntarily exchanging things at prices they agree on is not a neo-colonial imperialist capitalist evil that needs to be forbidden. It's what humans have always done naturally everywhere, including in Ethiopia.

It is evident that adopting a floating currency, allowing a market-driven exchange rate, removing legal barriers between markets, and facilitating voluntary price agreements can effectively address many of the current system's problems. Although the Ethiopian government has expressed intentions to unify the exchange rate, the process has been gradual, and the peg remains in place.

ReplyDeleteIn response, I contend that while your article raises valid concerns about the distortions caused by the foreign currency peg, an abrupt currency floatation may introduce its own challenges. Exchange rate volatility and the potential for rapid inflation could pose risks associated with a sudden shift. To ensure a smooth transition and mitigate potential negative consequences, it might be necessary to implement gradual reforms and engage in careful planning. Furthermore, the article primarily focuses on economic aspects while overlooking possible social and political implications that could arise from the suggested changes. Therefore, conducting a comprehensive analysis of the potential risks and benefits becomes imperative before implementing any major reforms to the foreign currency system in Ethiopia.

Thanks for the comment!

DeleteRe: risk of volatility.. I think I covered that in the post. "It is true that financial markets can be volatile but let's put that in perspective. That volatility is much less than the brutality of the practical forex market as currently experienced by Ethiopians today. The random shocks of getting or not getting a letter of credit are much worse. You can go for arbitrary length periods with an effective price of infinity and volume of zero! "

Apparent volatility in the official market may increase of course since a floating rate would be more variable than an artificial near constant peg. But the real volatility experienced by people could hardly be worse than it is currently. Most people simply can't get forex at the official rate. If they go to the black market, it's in practice an instant price jump from 55 to 105. If they don't to to the black market, it's like the price jumps from 55 to infinity. This is the reality. In a freely exchanged currency market, even the worst volatility in history is not as bad as the current situation.

Re: social impact... Again you have to consider the devastating current situation more completely for comparison. Manufacturing capacity is 50% idle... The impact on jobs is astounding already today.

Re: political implications... I agree. This is one area where change is dangerous. The current inefficiency is of course extremely profitable to some special interests at the expense of the general public and the economy. Narrow special interests are generally much more powerful forces, while the general social welfare doesn't have any concentrated power behind it. If one person is benefiting $100 and 100 people are losing $1, the one person will fight much harder to protect his interest than the 100 people.